Singapore Residency By Investment

Boost Your Freedom Without Compromise.

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

- The Global Investor Programme in Singapore requires an investment of at least SGD 2.5 million in a new business entity or in an existing Singapore business or approved fund.

- Benefits include access to a business-friendly environment, high-quality living, and strategic location for Asia-Pacific operations.

- The program allows for the inclusion of immediate family members, enhancing its appeal to investors seeking a base in Asia.

- Investment options are geared towards contributing to the economic growth of Singapore, emphasizing innovation and internationalization.

- The application process is thorough, with a focus on the investor's business track record and the investment's potential impact, typically taking several months to complete.

Singapore, often hailed as the Switzerland of Asia, isn't just an epicenter for business and innovation; it's a realm of opportunity for those looking to establish a firm base in Southeast Asia.

Singapore’s residency by investment program, also known as its Global Investor Program, is an alluring proposition, granting entrée to a land where traditional values seamlessly intertwine with modern visions.

Yet, despite the modernity of its urbanized landscape, Singapore is home to more than 2,000 native plant species, a testament to its commitment to biodiversity amidst its soaring skyscrapers.

In This Article, You Will Discover:

Join us as we unravel the intricacies of tapping into this fascinating island nation's potential.

What’s stopping you?

*Disclaimer: All amounts quoted in this article were correct and accurate at the time of publication and may have shifted since.

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

Free Consultation

Free Consultation Easy to Use

Easy to Use 100% Safe & Secure

100% Safe & Secure

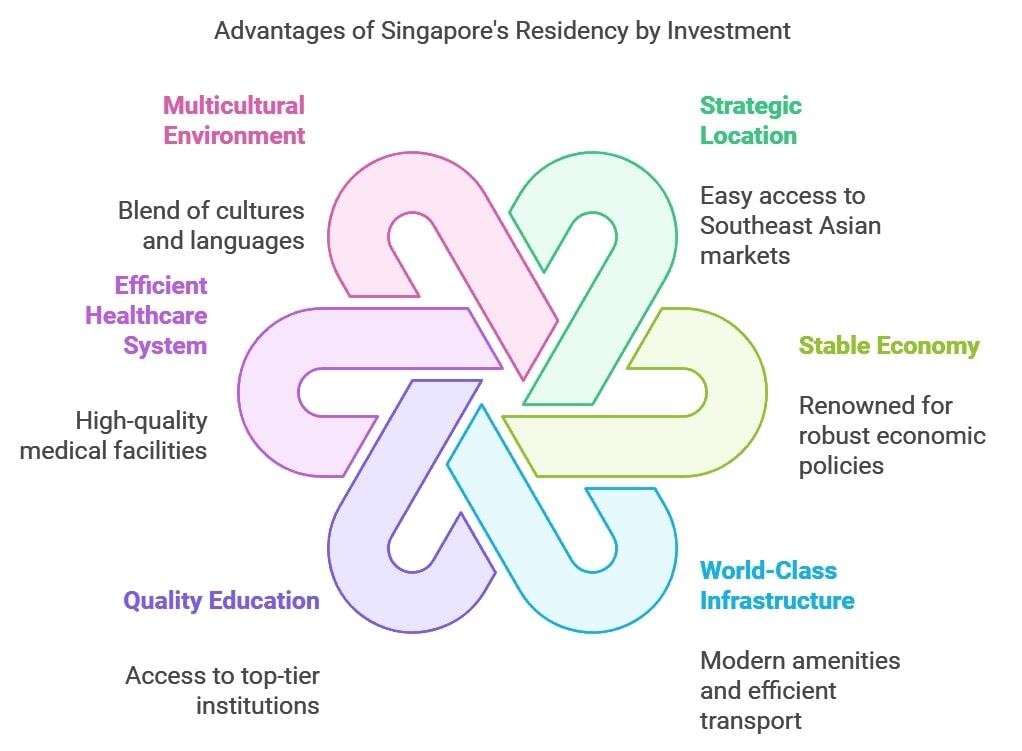

What Are the Benefits of Residency by Investment in Singapore?

The benefits of residency by investment in Singapore may seem obvious—from exceptional safety and security to its efficient government—but that’s only the beginning.

Our due diligence shows that these are the most salient benefits of this appealing residency program:

- Strategic location: Centrally positioned in Southeast Asia, Singapore offers easy access to booming markets in the region.

- Stable economy: Singapore is renowned for its robust economic policies, consistent growth, and financial stability.

- World-class infrastructure: Singapore boasts modern amenities, efficient public transportation, and cutting-edge technological integration.

- Quality education: You’ll have access to top-tier educational institutions and international schools.

- Efficient healthcare system: The state is known for its high-quality medical facilities and services.

- Multicultural environment: Singapore plays host to a blend of cultures and languages, promoting global networking and cultural integration.

- Transparent and efficient legal framework: Singapore is known for its clear and predictable regulations, which tend to be beneficial for business operations and personal matters.

- Low tax rates: You’ll be looking at competitive personal and corporate tax rates, coupled with numerous tax treaties.

- Safety and security: Singapore is among the safest cities in the world and is well-known for having an exceedingly low crime rate.

- Investment opportunities: In Singapore, you’ll enjoy a dynamic business environment with myriad opportunities in various sectors.

- Ease of doing business: Owing to many of the above-mentioned points, Singapore features processes and pro-business policies that facilitate smooth operations for entrepreneurs and investors.

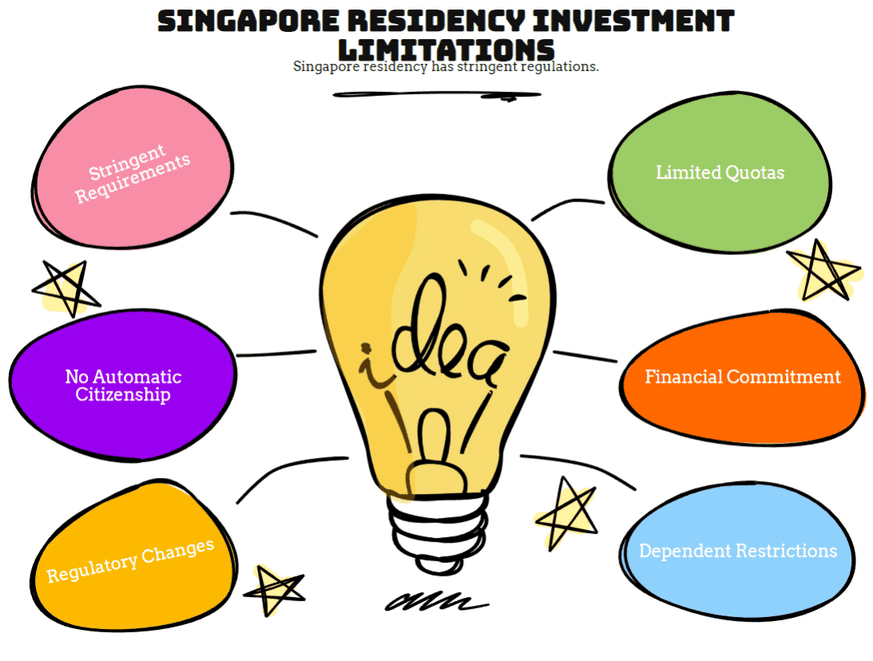

What Are the Limitations of Residency by Investment in Singapore?

The limitations of residency by investment in Singapore rest mainly on the rigorousness of the country’s regulatory environment.

As we see it, these are the main limitations of residency by investment in Singapore:

- Stringent requirements: You’ll face exceedingly high standards for investment amounts and specific qualifying criteria in Singapore.

- Limited quotas: Only a certain number of applications may be approved annually, creating competition.

- No automatic citizenship: Residency in Singapore doesn't automatically lead to Singaporean citizenship.

- Financial commitment: A substantial financial outlay will be required, which might be non-refundable in certain circumstances.

- Regulatory changes: The program's rules can change, potentially affecting existing and prospective investors.

- Dependent restrictions: Singapore imposes limitations on bringing certain family members or dependents into the country.

- Property ownership rules: There are restrictions on foreign ownership of residential property in certain areas.

- Due diligence scrutiny: Singapore conducts rigorous background checks on applicants, which can be time-consuming and invasive.

- Mandatory national service: Male children may be subject to Singapore's national service requirements upon reaching the age of 18.

- Cost of living: Singapore has one of the highest costs of living in Asia (and the world, for that matter), which can impact long-term residency plans.

- Duration of residency: Permanent residency status (your re-entry permit, specifically) expires after 5 years, and you must meet renewal stipulations to extend it.

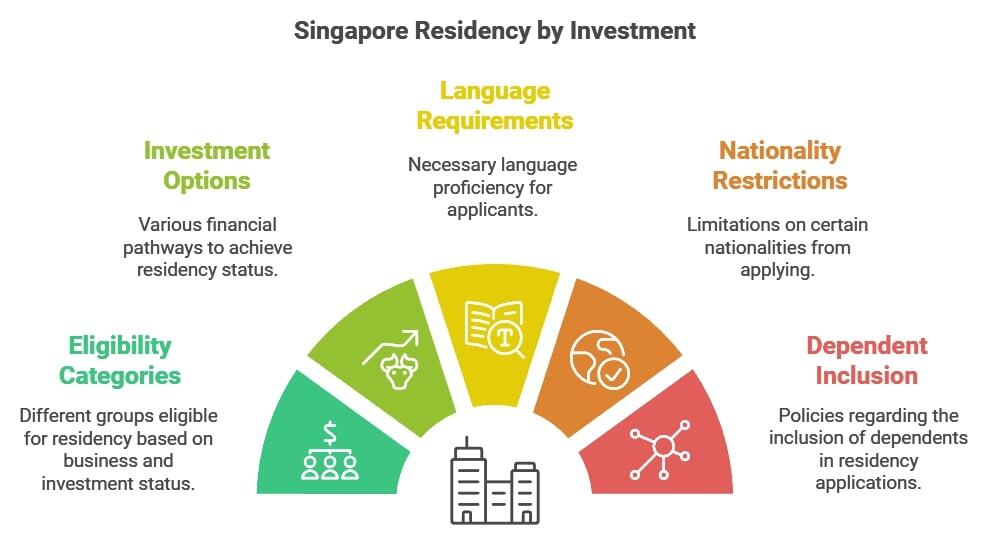

Which Investment Types Qualify for Residency by Investment in Singapore?

The investment types that qualify for residency by investment in Singapore range include 3 different options, generally referred to as Option A, Option B, and Option C.

In this section, we’ll talk about the investment routes; in the next section, we’ll break down the minimum investment amounts under each one.

Keep reading for all the details you’ll need.

Option A | Business Investment

Under this 1st option, you need to invest in a new or existing business

If you invest in an existing business, you must own at least 30% of the business.1

Moreover, the business must operate in one of the following industries:

- Aerospace engineering

- Alternative energy or clean technology

- Automotive

- Chemicals

- Consumer business (e.g. flavors and fragrances, food ingredients, nutrition, home and personal care)

- Electronics

- Energy

- Engineering services

- Healthcare

- Infocomm products and services

- Logistics and supply chain management

- Marine and offshore engineering

- Media and entertainment

- Medical technology

- Nanotechnology

- Natural resources (e.g. metals, mining, agri-commodities)

- Safety and security

- Space

- Shipping

- Pharmaceuticals and biotechnology

- Precision engineering

- Professional services (e.g. consulting, design)

- Arts businesses: (a) Visual arts businesses (e.g. auction houses, art logistics/storage); (b) performing arts businesses

- Sports businesses

- Family office and financial services

Wait, there’s more…

To qualify for a renewal of your permanent residency status, or “re-entry permit” (REP), when your initial residency by investment expires, you need to achieve certain deliverables.

These are:

- Hire at least 30 employees by the 5th year of your residency status.

- At least half of those employees must be local workers.

- At least 10 of those employees must be hired within the final 2 years.

Option B | Fund Investment

Invest in a fund that invests in Singapore-based companies.

This fund must be approved by the Singapore Economic Development Board (EDB).

Your investment in the fund must be actively maintained.

Option C | Single-Family Office

In this context, an Single-Family Office (SFO) is an entity that exists to manage the assets and finances of extremely high-net-worth individuals.2

Under this option, you must establish a Singapore-based SFO with significant assets under management (AUM).

At least one quarter of the AUM must be invested in any of the following 4 investment categories within 12 months of receiving your Final Approval letter:

- Companies listed on MAS-licensed exchanges

- Qualifying debt securities

- Funds distributed by Singapore-licensed or -registered managers

- Private equity injection into non-listed Singapore-based businesses

What Are the Eligibility Requirements for Residency by Investment in Singapore?

The eligibility requirements for residency by investment in Singapore are some of the most stringent in the world.

It’s no wonder that this program is considered to be one of the most exclusive globally!

A clean criminal record is an absolute must, but you’ll also need to prove your business-specific credentials.

Our expert team has done the groundwork for you.

Who’s Eligible to Apply?

Eligibility for this coveted RBI program is unfortunately not for everyone.

The following individuals are eligible to apply for Singapore’s residency by investment program:3

Established Business Owners

As an established business owner, you must prove the extent to which you’re established.

Under this category, you must fulfill all of the following criteria:

- You possess at least 3 years of entrepreneurial and business track record.

- Ideally, you currently run a company with:

- an annual turnover of at least S$200 million in the year immediately preceding your application, and;

- at least S$200 million per annum on average for the 3 years immediately preceding your application.

- If your company is privately held, you have at least 30% shareholding in the company.

- Your company is engaged in one or more of the industries listed under the Option A investment route.

Applicants in this eligibility category may choose to invest in any of the investment options.

Next Generation Business Owners

To qualify under this eligibility category, you need to prove several qualifying criteria.

These criteria are listed below:

- Your immediate family possesses at least 30% shareholding or is the largest shareholder in the company you use to qualify.

- This company’s annual turnover is:

- at least S$500 million in the year immediately preceding your application, and;

- at least S$500 million per annum on average for the 3 years immediately preceding your application.

- You (as the main applicant) are part of the management team of the company.

- The company is engaged in any of the industries listed under the Option A investment route.

Applicants in this eligibility category may choose to invest in any of the investment options.

Founder of a Fast-Growth Company

Founders of fast-growing companies, especially tech companies, qualify under this eligibility category.

These are the criteria to fulfill under this category:

- You’re a founder and 1 of the largest individual shareholders of a non-publicly listed company with a valuation of at least S$500 million.

- Your company is invested into by reputable venture capital or private equity firms.

- Your company is engaged in 1 or more of the industries listed under the Option A investment route.

Applicants in this eligibility category may choose to invest in any of the investment options.

Family Office Principals

To qualify as a family office principal, you’ll need to prove that you have significant experience in managing investments.

As this class of investor, you’ll meet the following criteria:

- You have at least 5 years of entrepreneurial, investment, or management track record.

- You have net investable assets of at least S$200 million.

Applicants under this eligibility category are restricted to investing in Option C only.

Minimum Investment Amounts

Every investment option requires a different investment amount.

Take a look:

Option A

The minimum investment required under Option A is S$10 million (approximately US$7.3 million) in a new business entity or existing business operation in Singapore.

As noted above, if you choose to invest in an existing business, you must own at least 30% of it.

Option B

Under Option B, you must invest at least S$25 million (approximately US$18 million) in a government-approved fund that also invests in Singapore-based companies.

Option C

For Option C, your Singapore-based SFO must have assets under management (AUM) of at least S$200 million (around US$146 million), of which at least S$50 million (approximately US$36 million) must be invested in 1 of 4 specific investment categories within 12 months of receiving your Final Approval letter.

The approved investment categories are:

- Companies listed on MAS-licensed exchanges

- Qualifying debt securities

- Funds distributed by Singapore-licensed or -registered managers

- Private equity injection into non-listed Singapore-based businesses

Language Requirements to Qualify

English language proficiency has been proposed as a prerequisite for residency in Singapore but isn’t mandatory yet.

English is the main business language utilized in Singapore; however, Mandarin, Malay, and Tamil are also widely spoken.

Nationalities Restricted from Applying

Currently, no nationalities are restricted from applying for Singaporian residency by investment.

Provided that you can demonstrate a clear criminal record and meet the investment requirements, your country of origin shouldn’t be a determining factor.

Will My Dependents Be Included Under My Singaporean Residency?

Yes, certain dependents will be included under your Sinigaporian residency.

Your dependents are eligible in the following ways:

- Your spouse and any children aged 21 years old or younger can apply alongside your resident by investment application.

- Your children who are older than 21 and your parents can apply for the 5-year Long Term Social Visit Pass (LTSVP), which is renewable and tied to the validity of your re-entry permit.

How Long is My Singaporean Residency by Investment Permit Valid & Can It Be Extended?

Regardless of the investment option you choose, the initial residency by investment permit, known as a re-entry permit (REP), will have the same duration of validity.

However, the duration of REP renewals varies depending on your fulfillment of various criteria during your initial residency by investment period.

Here’s what you should know:

Validity Period

The initial validity period of your re-entry permit (REP) is 5 years.

As its name implies, this permit allows you to leave and re-enter Singapore during those 5 years.

It’s incumbent on you to ensure that you apply for renewal through the Immigration and Checkpoints Authority (ICA) prior to the expiry of your initial REP.

Re-Entry Permit Renewal

You can renew your REP for 3 years or for 5 years.

Determining whether you’re eligible for either of these renewal categories depends on whether you’ve met the basic requirements under the investment route you chose during your initial 5-year permit.4

3-Year REP Renewal

We’ve summarized the criteria to apply for the 3-year renewal in the below table:

| 3-Year Re-Entry Permit Renewal Criteria | ||

| Option A Investors | Option B Investors | Option C Investors |

| You’ve fulfilled the investment conditions under Option A. | You’ve fulfilled the investment conditions under Option B. | You’ve fulfilled the investment conditions under Option C. |

| EITHER A or B Your Option A company in Singapore employs at least 30 employees (at least half of whom are Singaporians), and at least 10 are incremental employees. You or all your dependents have resided in Singapore for more than half of the time. | EITHER A or B You’ve maintained the S$25 million investment in a GIP-select fund. You or all your dependents have resided in Singapore for more than half of the time. | EITHER A or B The Single-Family Office that you established employs at least 5 incremental Family Office professionals (of whom at least 3 are Singaporians) and maintains the S$50 million AUM across any of the 4 investment categories. You or all your dependents have resided in Singapore for more than half of the time. |

5-Year REP Renewal

Below are the summarized criteria to apply for the 5-year renewal:

| 5-Year Re-Entry Permit Renewal Criteria | ||

| Option A Investors | Option B Investors | Option C Investors |

| You’ve fulfilled the investment conditions under Option A. | You’ve fulfilled the investment conditions under Option B. | You’ve fulfilled the investment conditions under Option C. |

| FULFILL BOTH A & B Your Option A company in Singapore employs at least 30 employees (at least half of whom are Singaporians), and at least 10 are incremental employees. You or all your dependents have resided in Singapore for more than half of the time. | FULFILL BOTH A & B You’ve maintained the S$25 million investment in a GIP-select fund. You or all your dependents have resided in Singapore for more than half of the time. | FULFILL BOTH A & B The Single-Family Office that you established employs at least 5 incremental Family Office professionals (of whom at least 3 are Singaporians) and maintains the S$50 million AUM across any of the 4 investment categories. You or all your dependents have resided in Singapore for more than half of the time. |

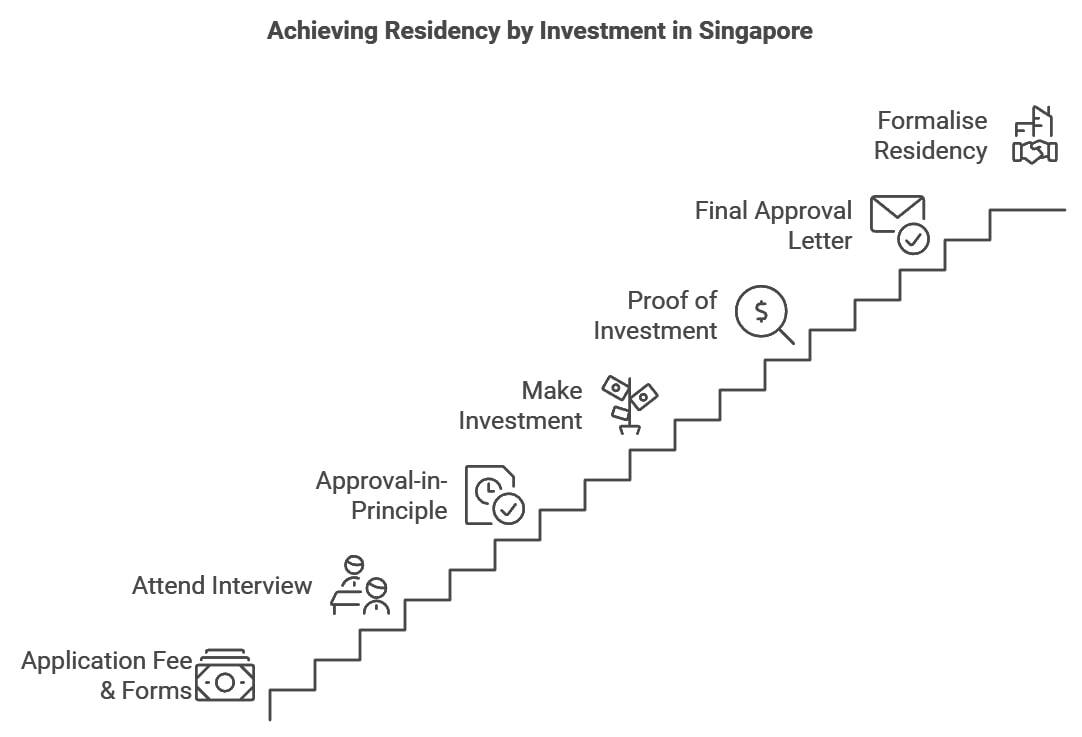

What’s the Application Process for Residency by Investment in Singapore?

The application process for residency by investment plays out over several months, owing to the rigorousness of Singapore’s vetting process.

Here follows a step-by-step guide, as well as the documents required.

Step-by-Step Application Process

Our seasoned WorldCitizenships professionals have summarized the application process into 7 steps.

Here’s what to plan for:

Step 1: Pay the Application Fee & Submit the Application Forms

Once you’ve paid the application fee, you’ll need to submit your forms online and in hard copy.

Forms must be submitted to the Singapore Economic Development Board (EDB).5

Step 2: Attend an Interview

If your application forms are approved, you’ll be invited to attend an interview with the EDB.

The answers you provide in this interview have a significant bearing on the ultimate approval of your application.

Step 3: Approval-in-Principle

If your assessment is successful, the ICA will issue an Approval-in-Principle (AIP) status to you.

This AIP is valid for 6 months.

Bear this in mind:

Depending on the investment option you choose, receiving your AIP letter will require you to provide specific supporting documents.

Step 4: Make the Investment

This crucial step requires you to fulfill the investment condition under the investment option you’ve chosen.

You must ensure that you make the investment within the 6-month validity period of your AIP letter.

Step 5: Proof of Investment

Once you’ve transferred your investment, you must provide evidence of it.

Appropriate ways of proving your investment has been made include certified copies of share certificates or bank statements.

You’ll also submit an Investment Undertaking on the terms and conditions of the investment.

Step 6: Final Approval Letter

Once your proof of investment documents are verified by the EDB, the ICA will issue the Final Approval letter.

Take special note

If you’re investing under Option C, you’ll need to demonstrate that at least S$50 million has been deployed into the stipulated investment categories no later than 12 months from the date of the Final Approval letter.

Step 7: Formalize Permanent Residence Status

Successful completion of the above steps doesn’t result directly in permanent residency; you’ll need to formalize your permanent residency status separately.

This must be done within 12 months of receiving your Final Approval letter.

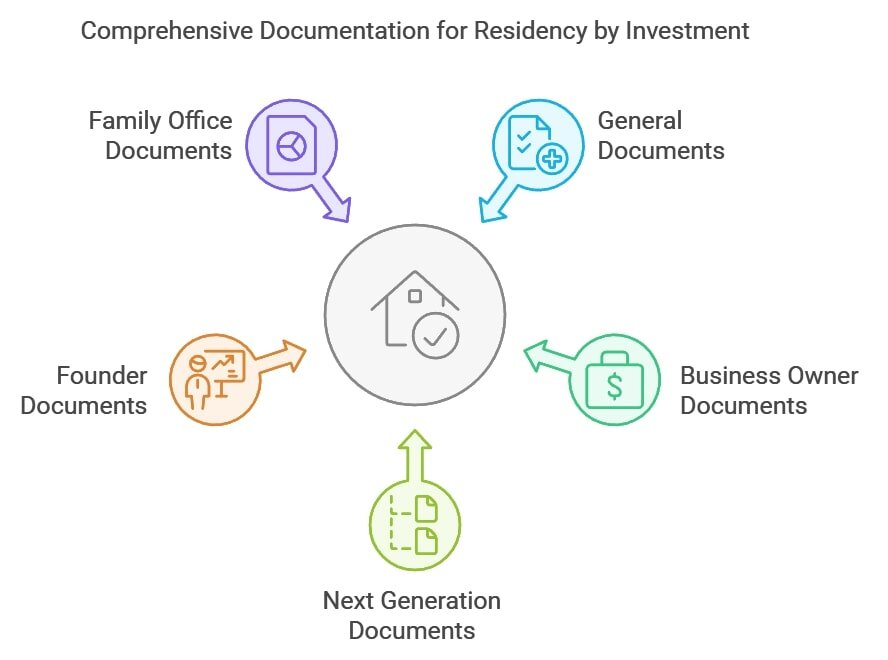

Required Documents

By now, you’ll have noticed that the application process for Singapore's Global Investor Program is extensive!

For this reason, you’ll want to ensure that all required documentation is complete and available.

In our experience, these are the most important documents you’ll need for your Singaporian residency by investment application:

Application Forms & Declarations

You’ll be required to fill out and submit a host of forms and declarations, which can be found on the EDB’s website.

These forms include:

- The Undertaking on the Terms and Conditions of the Global Investor Program

- The Statutory Declaration Form

- The Declaration form for Application of Global Investor Program in Form A

- The Declaration form for Application of Global Investor Program in Form B

- Payment details of Application Fee in Form C (with a hard copy of the payment transaction slip attached)

- A print-out copy of the GIP E-application form submitted online

- Application for an Entry Permit to Enter Singapore, Form 4

Supporting Documents

You’ll be required to submit general supporting documents and additional supporting documents, depending on the type of investor you are.

General supporting documents (required for every person included under your residency by investment application) include:

- Notarized copies of travel documents or passport pages showing personal particulars and official descriptions (if more than 1 passport exists, please include all of them)

- Notarized copy of birth certificate showing the names of both parents

- Notarized copy of official household census list or family registry (if applicable)

- Details of family members’ (applicant’s parents, siblings, children, and spouse) backgrounds

- Notarized copy of official marriage certificate (if applicable)

- Notarized copy of divorce certificate in respect of your previous marriage(s) (if applicable)

- Notarized copy of custody papers or adoption papers for children below 21 years of age from your previous marriage(s) (if applicable)

- Notarized copy of “Deed Poll” or “Change of Name” certificate (if applicable)

- Passport photographs (1 for Form A and 1 for Form 4)

If you’re investing as an established business owner, the following supporting documents will be required with your residency by investment application:

- Original audited financial reports (for the last 3 years) of your main business as listed in Form A

- The latest notarized copy of documents stating your share ownership of the main business and any other business included in the application.

- A diagrammatic illustration of the shareholding structure of your main business

- The latest notarized copy of the business registration certificate or business license for your main business and any other business included in the application

- An organization chart of your main business and any other business included in the application

- A detailed business plan in addition to Form B. The business plan must be in English.

- A copy of Accounting and Corporate Regulatory Authority (ACRA) registration of your Singapore investment (if applicable)

If you’re investing as a next generation business owner, the following supporting documents will be required with your residency by investment application:

- Original audited financial reports (for the last 3 years) of the main business of your immediate family as listed in Form A

- The latest notarized copy of documents stating your immediate family members’ share ownership of the main business

- A diagrammatic illustration of the shareholding structure of your immediate family members’ share ownership of the main business. You’ll need to detail the computation of how your immediate family members’ shareholding in the company is derived.

- The latest notarized copy of the business registration certificate or business license for the main business of your immediate family

- An organization chart of the main business of your immediate family

- A detailed business plan in addition to Form B. This business plan must be in English.

- A copy of Accounting and Corporate Regulatory Authority (ACRA) registration of your Singapore investment (if applicable)

If you’re investing as the founder of a fast-growing company, the following supporting documents will be required with your residency by investment application:

- Original financial reports (for the last 3 years) of your main business as listed in Form A.

- The latest notarized copy of documents stating your share ownership of the main business

- The latest notarized copy of valuation report (or an equivalent document) of the main business

- A diagrammatic illustration of the shareholding structure of your main business

- The latest notarized copy of list of investors in the main business

- The latest notarized copy of the business registration certificate or business license for your main business

- An organisation chart of your main business

- Detailed business plan in addition to Form B. This business plan must be in English or translated into English

- A copy of the Accounting and Corporate Regulatory Authority (ACRA) registration of your Singapore investment (if applicable).

If you’re investing as a family office principal, the following supporting documents will be required with your residency by investment application:

- The latest certified statement to demonstrate that you or your direct family has net investable assets of at least S$200 million. The net investable assets must be certified by a Singapore-based accredited audit firm, bank, law firm, or trust company, subject to the EDB's approval.

- A detailed business plan in addition to Form B. This business plan must be in English or translated into English.

- A diagrammatic illustration of the shareholding structure of the (i) Singapore-based Single-Family Office and the (ii) S$200 million assets that it will manage.

- A copy of Accounting and Corporate Regulatory Authority (ACRA) registration of your Singapore investment (if applicable).

- An overview of your main business (if applicable) and a business plan for your main business in Singapore (if applicable).

What Costs Are Involved in Getting Residency by Investment in Singapore?

The costs involved in getting residency by investment in Singapore range from the significant application fee to additional associated costs such as notary fees and possible translation fees.

Here are some of the main costs to plan for as you prepare your budget:

Application Costs

The fee to submit Singapore’s residency by investment application is S$10,000.

Once this has been paid, you have 1 month to submit your application forms.

Legal & Advisory Costs

The legal and advisory costs of applying for residency by investment in Singapore will likely be significant.

These are some of the most common ones:

- Legal consultation fee: These are costs associated with obtaining legal advice on the application process.

- Document preparation fee: These fees are charges for the preparation and notarization of required legal documents.

- Advisory fees: These are the costs that consultants or organizations charge for guiding applicants through the entire residency process. These can vary widely.

- Liaison fees: These pertain to possible costs associated with liaising with Singaporean authorities on the applicant's behalf.

Additional Associated Costs

It’s worth noting that actual additional costs can vary according to your circumstances and the complexity of your application, but in our view, it’s better to be safe than sorry!

Here are some additional costs that our team often sees crop up:

- Translation and certification: These are the fees for translating documents into English (or other required languages) and for official certification. Remember that all forms and supporting documents must be submitted in English or with an English translation.

- Medical examination fee: This fee is associated with mandatory health checks or medical examinations.

- Insurance: The premiums for any required health or investment insurance.

- Real estate transaction costs: These include charges such as stamp duties, agent fees, or property taxes for real estate purchases.

- Bank charges: Any fees associated with transferring investment amounts or setting up bank accounts in Singapore.

- Dependent application fees: Any additional charges for including family members or dependents in the application.

- Renewal and maintenance Fees: Costs associated with renewing or maintaining investments and residency status, such as re-investment stipulations or periodic reviews.

- Miscellaneous administrative costs: These costs are for any unforeseen expenses related to documentation, courier services, or other ancillary requirements.

What’s the Processing Time for Residency by Investment Singapore?

The exact processing time for residency by investment in Singapore may vary, depending on your unique circumstances.

Let’s shine a torch on this matter.

Average Processing Time

On average, the processing time for Singapore’s Global Investor Program (GIP) ranges from 9 to 12 months.

Factors Affecting Processing Time

Various factors can affect the processing time of your Singapore residency by investment application.

These can include:

- Completeness of application: Applications that are fully complete with all the required documents are processed faster. Missing or incomplete documentation can lead to delays.

- Due diligence delays: Thorough background checks, vetting of financial sources, and investigation of provided documents can take time, especially if inconsistencies are found.

- Volume of applications: High demand periods or an influx of applications can lead to longer processing times as authorities work through the backlog.

- Legal or administrative hold-ups: Any challenges or queries related to the application's legality or associated businesses can cause delays.

- Dependent applications: Including family members or dependents might increase the scrutiny level and thus the processing time.

- Changes in regulation: Any sudden changes or amendments in Singapore's residency by investment policy can affect processing durations.

Expedited Processing Options

Currently, no expedited processing option exists for the Singapore Global Investor Program.

Our advice in this regard is to ensure that you submit a complete and organized application within the stipulated time frames; this tends to ensure efficient and timeous processing.

How Soon Will I Receive My Residency Permit After My Residency by Investment Application is Approved?

After your residency by investment application is approved, you have to apply to formalize your permanent residency status in Singapore through the ICA.

Receiving your residency permit is, therefore, your responsibility.

You’ll have 12 months to formalize your residency status after receiving the Final Approval letter for your GIP application.

What Are the Tax Implications of Residency by Investment in Singapore?

The tax implications of residency by investment in Singapore are significant in that they generally constitute tax relief.

In fact, Singapore is widely considered to be a low-tax jurisdiction.

In Singapore, you’re considered a resident of Singapore if you reside there, are physically present, or exercise employment (other than as a board director of a company).6

Here are some of the most pertinent tax implications of residency by investment in Singapore:

- Progressive income tax: Residents are subject to a progressive personal income tax, which starts at a low rate and increases with higher income brackets.

- No capital gains tax: Singapore doesn’t impose capital gains tax, making it attractive for investment growth.

- Favorable dividend tax: Dividends received from Singaporean companies are often tax-exempt for residents.

- Foreign-sourced income: Depending on conditions met, foreign-sourced income remitted to Singapore might be tax-exempt or subject to reduced taxation.

- Goods and services tax (GST): Singapore has a GST, but certain financial services and the export of goods can be zero-rated or exempt.

- Estate duty abolished: There’s no estate duty or inheritance tax in Singapore since 2008.

- Tax treaties: Singapore has an extensive network of Double Taxation Avoidance Agreements with various countries, minimizing the risk of being taxed twice on the same income.

- Tax residency status: The tax implications can vary depending on whether an individual is considered a tax resident or non-resident.

- Property tax: Owners of real estate in Singapore are subject to property tax based on the property's annual value.

- No net wealth tax: Singapore doesn’t levy a net wealth or net worth tax on residents.

Is Residency by Investment in Singapore a Pathway to Singaporean Citizenship?

Yes, residency by investment in Singapore can be a pathway to Singaporean citizenship.

After 2 years of maintaining your permanent residency status in Singapore, you can apply for citizenship and the exceptionally strong passport it provides.

However

Singapore doesn’t recognize dual citizenship.

This means that you’ll have to renounce any other citizenship you may hold in order to become a Singaporean national.

Common Questions

Is a Re-Entry Permit the Same Thing as a Residence Permit in Singapore?

Does Military National Service Apply Even If I’m Not a Singaporian Citizen?

How Much Do I Have to Invest in Singapore to Get Permanent Residency?

How Do You Qualify for a Singapore Investor Visa?

How Risky Is Residency by Investment in Singapore?

What Language Is Spoken in Singapore?

Can I Get Residency by Investment in Singapore by Buying Property?

Is It Expensive to Live in Singapore?

In Conclusion

The Global Investor Program in Singapore offers a golden opportunity for discerning investors to merge their financial aspirations with a life in one of Asia's most dynamic and stable environments.

As with any significant decision, the journey to Singaporean residency is brimming with nuances, costs, and benefits.

With its robust economy, strategic location, and multicultural fabric, Singapore beckons as an optimal choice for those seeking a blend of business growth and quality of life.

Feel free to peruse our articles on residency investment programs in other Asian and South Pacific countries; otherwise, Lion City offers a compelling proposition worth considering!

Learn More: Residency by Investment in Asia & the South Pacific

- Who offers the CHEAPEST program available.

- Who offers the BEST program available.

- What you need to qualify?

Free Consultation

Free Consultation Easy to Use

Easy to Use 100% Safe & Secure

100% Safe & Secure